|

In case you are actually contemplating asking your credit card provider for an increase there are a few things you need to think about initially. There are pros and cons to improving your credit limit. Hopefully you've pretty much placed yourself ready to inquire about an increase. If you have not listed below are several tips to get you all ready.

Prove to Banking Institution You're Responsible The very first step in getting approved for an increase in your credit limit is have you been responsible. Have you been responsible with the credit line you currently have? If you have paid your bill promptly monthly this is a great indicator - refer to creditlimitincrease.citi.com. If you have kept your credit utilization within 30% this is generally good as well. You will definitely hurt your chances of getting authorized if you have skipped payments. For at minimum 6 months you need to pay your bills promptly. If your credit card is maxed out you will minimize your possibilities of getting approved. Another red flag is making late monthly payments. Any cardholder that can avoid from these kinds of oversights will certainly have a far better chance of getting approved. Plead Your Case If you are simply determined for a credit line increase look at calling your credit issuer and talk with customer care. You will need to persuade them that you are in a desperate circumstance. You will most likely need to assure them that you are an accountable cardholder. A couple of pointers you can easily utilize to argue your point are shown below: You've paid your debt on schedule every month Your wage is constantly improving especially lately You regularly pay beyond the smallest payment Your balance is paid in full each month The above reasons are fantastic instances you can use to plead your case. The minute you speak with somebody in customer service you will certainly need to be well-mannered and kind to the person. You by no means want to be nasty to them considering that they are doing you a favor. Request A Paltry Increase The last thing you want to do is request for much more than you need. You don't want to substantially increase your limit. This might be a dead giveaway to the company and trigger a rejection. Know how much you would like to raise your limit in advance. Never ask the customer care professional for their thoughts either. A good strategy of an increase would be ten percent to 25%. If you have a $2000 credit line then ask for 10% to 25% of that which would equal somewhere around $400.

0 Comments

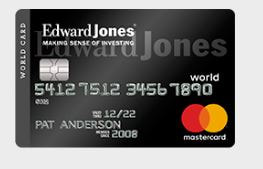

There are a lot of plastic card offers that arrive in the mail for some homes monthly. Credit card institutions are offering consumers extra rewards, low interest rate credit, and balance transfer promotions. They give plenty of advantages that lure clients to apply for a charge card. A simple strategy of charge card companies would be to offer their long time clients a credit limit increase via creditlimitincrease.citi.com. Oftentimes these credit limit increases arrive in the mail or even in your inbox. They advise you that you will be approved with an increase. Recently companies are simply adding the increase to your credit card account without your knowing. Before you imagine twice about employing your new personal line of credit there are some things to consider. There are cons of an growing credit limit specifically people who aren’t financially responsible. Possibility For More Indebtedness For too many people the additional credit could increase your debt levels. You might want to spend more money and make use of some of your brand-new credit to create more purchases. If you've got a spending issue you will want to be extra careful that you simply don’t accumulate extra debt. To stop additionalsurplus debt overburden it will always be smart to pay off the money you owe following month after month. If you are having trouble achieving this then you most definitely should educate your bank card company to cut back your credit limit. Every person who receive an increase isn’t fully ready to govern a plastic card having a higher limit. More Inquiries On Your Credit Report If you are searching for a credit limit increase one point to take into account will be your credit rating will take a hit. Credit card fims should look at your credit history to determine in case you be entitled to a credit limit. Your credit score may fall as a result of these hard inquiries. Before requesting a credit limit increase it's a good plan to schedule an appointment with someone from customer satisfaction to ascertain if they'll be doing a hard inquiry. Typically here is the way for giving a credit increase however, you still must check anyway. The answer to managing your cards sagaciously is that you should keep your account in good standing. If one does so you will likely be approached for the credit limit increase but it’s your choice if you take it.  To control their expenditures better patrons of Edward Jones have many plastic card and loan options available. They can request a personal bank loan, credit cards, or use atm cards. Edward Jones has these offers for clients so they really don’t need to seek another location. Edward Jones Personal Credit Cards There are 2 types of cards for customers to get, the Edwards Jones World Mastercard as well as the Edward Jones World Plus Mastercard. Each card possesses its own advantages and perks and you will have to determine what's best for your requirements - learn how to access your plastic card edwardjonescreditcard. The World Mastercard emphasizes a lower rate of interest and new customers can acquire a $100 Loyalty Invest Deposit. This individual fringe benefit is merited after having a card member has spent five hundered dollars in acceptable net purchases inside of ninety days of opening their account. The World Plus Mastercard permits card members to earn as much as $200 in Loyalty Invest Deposits. They will receive $100 after working two thousand dollars in eligible net purchases within 3 months of opening their account. They may also purchase an spare one hundred dollars after working $30,000 in eligible net purchases throughout the first yr of being a member. Edward Jones Business Credit Cards The Edward Jones Business Plus Mastercard is the signature business card for that investment firm. The card includes a unique offer of $150 Loyalty Invest earnings we have spent $1,000 in your card within 3 months of opening your bank account. There is no annual fee if one makes at least one purchase to your annually. If you cannot you'll cough up a $25 annual fee. Edward Jones Debit Cards If you would like to utilize a debit card using the funds inside your Edward Jones Money Market Fund or Insured Bank Deposit account, this option can be acquired. Debit cards have become much like by using a check or cash except the funds are electronically sucked from your money. Many people prefer to carry a debit card than cash since it is extremely convenient and safe and sound. There is not any should carry cash when you can make use of debit card.  American Express is providing customers the Bluebird Card the alternative to banking. Individuals that battle to obtain a checking account is capable of doing lots of the same functions via a prepaid card. The card will not limit people as well as their spending. Through the Amex logo users can purchase anywhere the logo is accepted. Lots of people are utilizing prepaid credit cards that is why as well as other explanations. If you've got a Bluebird card figure out how to activate it at bluebird.com/activate card. Another justification many people are utilizing the Amex Bluebird Card is that they can protect the bank-account. All they must do is add money to their Bluebird card and commence spending. Using their Bluebird prepaid card often limits the requirement to use their plastic card lowering fraud. BlueBird Card Features There exist several attractive features with all the Bluebird card. You will have to compare these differences making use of their competitors to find out where did they rank. No monthly fee No annual fee No overdraft fee No minimum balance No credit review Add funds totally free via direct deposit, your banking account, mobile check deposits, or at Walmart Pay bills online or via mobile app BlueBird Card Registration Once you determine to make use of a Bluebird debit card the next thing is to identify a Bluebird Account Set Up Kit from Walmart. The kit costs only $5 to obtain. The kit features a temporary Bluebird card. While you are spending money on the kit on the cash register you can even add money instantly towards the card. The second step would be to sign up for your permanent debit card. This process is possible online via the Bluebird activation website. At the web page you will find there's Register button which has a form for being completed. Some in the details that should be entered will be the temporary card number, your company, make a password, create an ATM PIN, etc. Lastly look at the tos and select the AGREE and SUBMIT button. When your banking account is eligible you will receive a Welcome email from American Express. Your new permanent card is going to be submitted within the mail that you should receive within 7 working days. After you get your new card it will likely need to be activated which is often easily done online. It could be activated by calling the toll free number about the card. After all stuff has completed start adding funds to your card and initiate spending.  For the past few years remote controlled drones are actually very well received by consumers. There is definitely a growing segment of society that desires their own drone to fly. If you’ve watched someone at the beach or perhaps a wide open park flying a drone then you know how exciting it may be. They have a great deal of range and stability. Drones like the SkyCamHD Wifi Drone have the ability to maneuver around objects, avoid colliding into objects, and so are quickly. All of the security measures designed in a drone to hold it from crashing is exactly what attracts customers in their mind. They can be a huge investment and no one would like to perpetually spend cash buying parts and putting it together again after a crash. With the newest technology that drones are made with they're more difficult to crash. This is valid for that top quality drones and several with the cheaper ones. When you’re out purchasing a nice drone always consider the built-in features for avoiding potential accidents. Here are some other functions to take into account: Battery Life The average battery life for many drone is anywhere from 10-20 minutes. You should understand this when searching for one. With today’s technology the flight time is still quite short lived but it’s incrementally convalescing. When charging up your battery normally it can take around 30 minutes to get a full charge. If battery is a big matter of yours then it’s imperative that you appreciate this now. Drone Range I think most of the people will be impressed while using range many drones can travel. Under your control drones can extend in the market to one mile possibly even which is often a good way. You may wish to understand the farthest distance they could travel out. When they get to the end of these range they are going to signal you to help you maneuver it back. Depending on what your plans are along with your new drone the controllable range is vital. You may have a job that will need taking pictures or just getting aerial photography. Knowing the distances prior to making an investment is critical. Farmers use drones for vast farm lands and this is one thing that is important to them. Hi-Def Camera Of course no drone is complete without it’s hi-def camera. They are fantastic at taking HD photos or video. Drones have built-in cameras that produce new angles for photos and video. Your common smartphone or standalone camera isn’t designed for producing these images. The camera ought to be advanced in order to go ahead and take very best images possible. |

RSS Feed

RSS Feed